Understanding Digital Currency in India

Imagine using a form of digital money for transactions and market activities without needing a central authority like banks. This digital currency is securely stored and managed on your behalf, making it hassle-free and safe.

What is Digital Currency?

Digital currency, also known as cryptocurrency or digital assets, is managed, stored, and exchanged online. It uses cryptography for secure transactions, allowing electronic money systems to operate without central control. In India, digital currency is in a regulatory grey area, with the government taxing it but not recognizing it as legal tender.

Leading Digital Currency in India

GanderCoin

GanderCoin, listed on CoinCRED, is one of India’s top digital currencies. It uses the secure scrypt algorithm for encryption, ensuring data protection from hackers. As a decentralized network, GanderCoin facilitates transactions without a central authority.

GanderCoin (GAND) Price:

- Initial Price: $0.78

- Current Price: $1.005

GanderCoin has shown significant growth, attracting a large user base and offering high profit potential and security.

| Feature | Description |

|---|---|

| Initial Price | $0.78 |

| Current Price | $1.005 |

| Algorithm | Scrypt |

| Exchange | CoinCRED |

| Advantages | Secure, decentralized, high profit potential |

| Transaction Speed | High |

| Processing Expenses | Minimal |

Advantages of Digital Currency in India

- Durability: Digital currency avoids the risks of physical damage or loss.

- Longevity: Digital currency outlasts physical currency.

- International Transactions: Facilitates hassle-free international transactions without intermediaries.

- Traceability: Digital currency transactions are traceable, aiding users in proving creditworthiness.

Key Features of GanderCoin

Transactions

GanderCoin allows direct user-to-user transactions without banks. It operates on a P2P network, ensuring decentralized transaction authorization.

High Speed

GanderCoin offers high transaction speeds with minimal fees, allowing quick and secure payments.

Minimal Processing Expenses

GanderCoin trading comes with low fees, offering various advantages and revenue streams, making the decision-making process simple for users.

Strong Security for Users

GanderCoin provides a secure trading environment with end-to-end encryption. It is user-friendly, even for new traders, ensuring all transactions are protected.

How to Buy Digital Currency in India

Step-by-Step Guide to Buying GanderCoin

Create an Account on CoinCRED:

- Download the CoinCRED app and register with your details.

- Verify your account with a six-digit code sent to your phone and email.

Log in to Your CoinCRED Account:

- Enter your email and password, followed by a 4-digit PIN.

Deposit Funds into Your Wallet:

- Choose your payment method and deposit INR into your wallet.

Buy GanderCoin:

Receive GanderCoins according to your deposited INR.

Select GanderCoin from the market and click “Buy.”

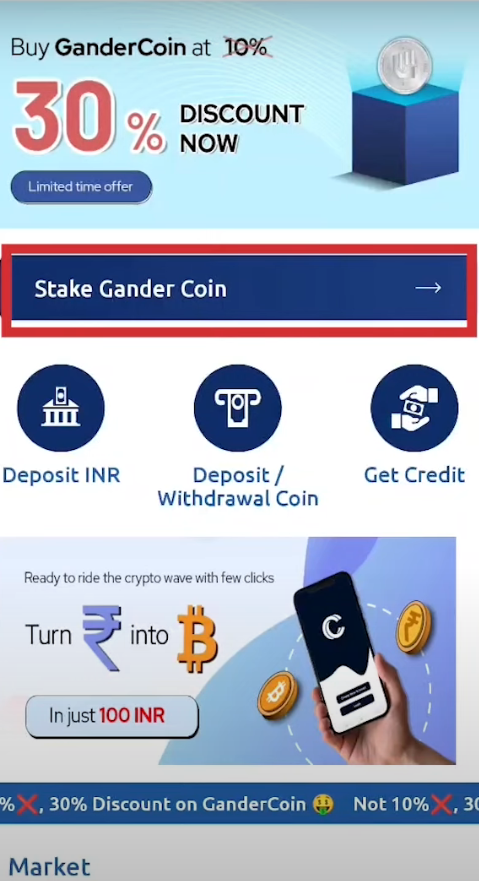

How to Stake GanderCoin

To earn extra income, stake your GanderCoins by following these steps:

1

Open CoinCRED Application:

Click on Stake GanderCoin.

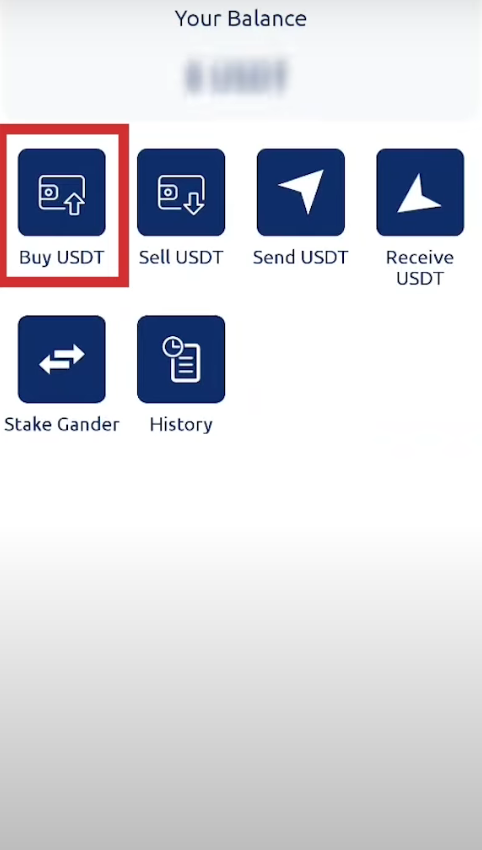

2

Buy USDT:

Stake the desired amount and click Submit.